Oregon

This area is populated with four million people and the majority of retirees making up this sum can be found on the Gold Beach coast. The healthcare costs in this state are relatively good and are at 2.6 percent below the average in the US.

Oregon

Maryland

The retiree population in Maryland generally likes living in Chevy Chase Village. The average household expenses for seniors are the second-highest in the country. Nonetheless, the area is beautiful to live in and call home. However, it might not fit all seniors’ retirement funds.

Maryland

Colorado

The cost of living in Colorado is 17 percent higher than the US average, which might pose a problem for some retirees. With that being said, Colorado Springs is well-liked for its senior community. The state is also ranked four in senior health rankings.

Colorado

Vermont

Vermont is also known as the Green Mountain State and is surrounded by nature to ensure that you remain healthy and get the fresh air you need in your twilight years. It has one of the smallest populations in the US.

Vermont

Delaware

Delaware is well-liked for being tax-friendly because it doesn’t have any tax associated with Social Security benefits. Not to mention, the state also exempts particular amounts of senior investments and pension incomes. Rehoboth Beach is known for having a great senior community.

Delaware

Virginia

Many retirees like living in an area situated in Virginia called Roanoke. However, the incomes are relatively high in this region, which means that the cost of living can be considered high. With that being said, Social security doesn’t get taxed and healthcare is affordable.

Virginia

Utah

If you’re planning to retire in Utah, it would be good to know that the United Health Foundation has recorded the state to have the second-best senior health care in the country. Not to mention, nature and outdoorsy environment can make retiring here very pleasant.

Utah

Nevada

Nevada is equipped with excellent deals when it comes to taxes. One of these tax benefits is that the lack of income tax can help seniors preserve their money. In addition to this, poverty rates associated with older generations are low.

Nevada

Minnesota

If you’re primarily considered your health when looking at a place to retire, the United Health Foundation found Minnesota to be the healthiest state in the country. It’s home to Mayo Clinic, which means you should consider Minnesota if you have severe health conditions.

Minnesota

South Dakota

South Dakota is home to Hot Springs, which is exceptionally well-liked among senior citizens. In addition to this, South Dakota is the most tax-friendly state in the US. Its affordability and landscapes are the most well-liked features of this state.

South Dakota

Montana

Retirees seem to be quite fond of one city in Montana called Glasgow. There’s no doubt that Montana is a beautiful state. It’s home to Glacier and Yellowstone National Parks. Not to mention, it also has the biggest population of retirees in the country.

Montana

Arizona

Arizona has a population of 6.7 million residents and many of the retirees living in this state take Green Valley their home. It provides excellent views and plenty of sunshine. This is the right state for you if you’re looking to avoid an icy winter

Arizona

North Dakota

Yet another tax-friendly state, North Dakota only enforces income taxes at 1.1 to 2.9 percent. However, the state does tax retirement income. With that being said, the cost of living is one percent higher than the average and it has breathtaking natural landscapes.

North Dakota

Florida

Sunshine State is one of the most tax-friendly states in the US, which is why many retirees flock to Florida. You can find many retirement communities in Jacksonville. There’s a reason why Florida is known for its many retirees.

Florida

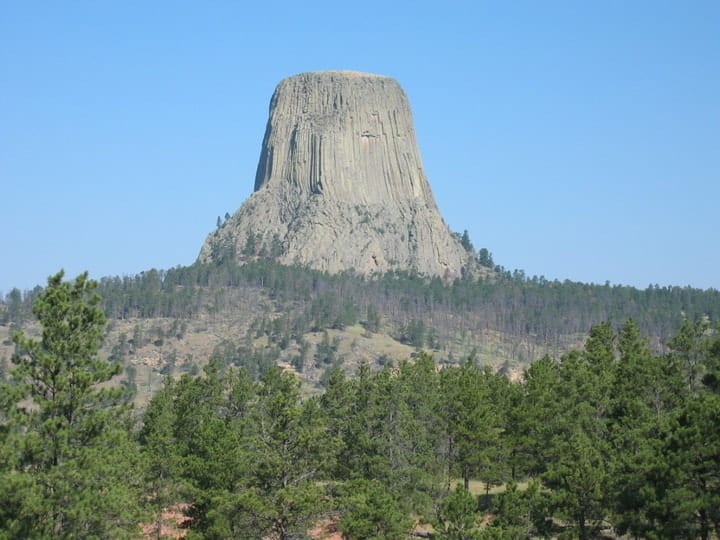

Wyoming

The population making up Wyoming makes it better suited for those who enjoy nature and aren’t city dwellers. From 577,000, many of these residents prefer Cody. It’s also good to know that the state ranks high when looking at fiscal health.

Wyoming

Maine

The cost of living in Maine is two percent lower than the national average and the state has a population of 1.3 million. The health care expenses associated with living in this region are lower than the country’s average. However, retirement income is taxed.

Maine

Pennsylvania

If you’re a city dweller, you would like the fact that Pennsylvania is home to 12.8 million people. Pittsburgh is a well-liked choice among senior residents. Forbes has even gone on to state it as being the best city in the US to retire in.

Pennsylvania

Wisconsin

Certain tax breaks are associated with low-income retirees and the low of living is low. Not to mention, you can spend your twilight years eating the best cheese if you’re a cheese-lover. Social security is also exempt from being taxed.

Wisconsin

Illinois

Illinois has a cost of living that’s four percent lower than the US average. However, the state is also known as the second-lowest fiscally secure state. The tax breaks associated with retirement incomes aren’t guaranteed and the sales taxes are known for being high.

Illinois

Idaho

Nature lovers are bound to have a blast with Idaho’s rugged landscape. It’s home to many canyons, lakes, and mountains. The cost of living is five percent lower than the national average. The city of Sandpoint is well-liked by retirees.

Idaho

New Mexico

If you’re looking for a peaceful place to spend your twilight years, New Mexico is a perfect choice. The cost of living is five percent lower than the country’s average. Taos is excellent for seniors and has been voted as the best city in the state.

New Mexico

North Carolina

The weather throughout the year in North Carolina is generally mild, which makes it the perfect place for nature lovers. The cost of living is low and sits at five percent lower than the U.S average. However, it also has a population of 9.9 million, making it a percent for city lovers as well.

North Carolina

South Carolina

South Carolina has a cost of living that’s seven percent lower than the national average. The city of Bluffton is an excellent choice for those who are looking for a mild year-round temperature. Not to mention, this state is also tax-friendly.

South Carolina

Georgia

This Southern state is home to the city of Athens, which is an excellent place for retirees to call home. The state of Georgia has warm weather and low living costs. Not to mention, the state taxes are also relatively low.

Georgia

Missouri

Retirees living in Missouri rave about the low living expenses that come with residing in this state. It’s 10 percent lower than the average living costs in the US. Bookworms also enjoy that many famous writers come from the state of Missouri.

Missouri

Texas

Texas is the home city to more than 27 million residents. One of the most well-lied things about Texas is that it has an incredibly low cost of living that’s 10 percent below the national average. San Macros is where you can find the most retirees.

Texas

Louisiana

Louisiana is appealing to many senior citizens. New Orleans is a fascinating city that holds a special place in many people’s hearts. However, the city of Baton Rouge is an excellent destination for retirees. The state is mainly known for its swamps, cuisine, and music.

Louisiana

Nebraska

The affordability in Nebraska is one of the best in the country as its cost of living is 12 percent below the average. In addition to this, it also has excellent fiscal health. Not to mention, the city of O’Neill has been voted as one of the best cities for retirees.

Nebraska

Tennessee

One of the best well-liked things about Tennessee that makes senior citizens flock is that it doesn’t levy state income taxes. Lookout Mountain is well-liked among senior citizens for its beautiful landscapes and low cost of living that sits at 12 percent below the average.

Tennessee

Ohio

The geographical positioning of this state makes it great for traveling across the country. For this reason, many retirees make this their home. If you’re interested in living in the Buckeye State as a senior citizen, it’s highly recommended that you check out Bellbrook.

Ohio

Michigan

For the majority of retirees that make up the population of Michigan, many of them call Farmington home. There are various reasons for this, but the state’s beautiful landscapes and peaceful neighborhoods. However, the tax situation is said to become worse in the following years.

Michigan

Iowa

If you’re a literature lover, you’re bound to find the state of Iowa an excellent home for your retirement years. Iowa City is a UNESCO ‘City of Literature’ and has an excellent cultural scene. Not to mention, there isn’t any income tax on Social Security.

Iowa

Alabama

The Heart of Dixie, also known as Alabama, is a budget-friendly choice for those who are looking to retire. Income taxes are kept relatively low while Social Security is exempt from any taxes. Nonetheless, you should expect hot summers.

Alabama

Kansas

Retiring in the Sunflower State is a great idea for most. The main reason for this is because the cost of living sits at 14 percent lower than the US average. One of the most well-liked aspects of this state is its scenic natural landscapes.

Kansas

Kentucky

Kentucky also referred to as the Bluegrass State, is the perfect location if you like the idea of retiring in a state that’s rich in music and architecture. Not to mention, Social Security and some income taxes are exempt in this state.

Kentucky

Mississippi

One incredible feature about the state of Mississippi is that it has a cost of living that’s 15 percent lower than the US average. Although the Hide-A-Way Lake area doesn’t come with the best name, it’s an ideal option for senior citizens.

Mississippi

Indiana

Indiana is one of the best choices for retirees who are looking for a state to retire in that offers excellent attractions and tax benefits. It also has a low cost of living that’s 15 percent lower than the national average.

Indiana

Oklahoma

The state that offers the best quality of life is difficult to name, but Oklahoma can be considered a contender for this title. It boasts a cost of living that 16 percent lower than the national average and Social Security isn’t taxed.

Oklahoma

West Virginia

In our opinion, West Virginia is one of the best places to retire. The Mountain State is equipped with epic sceneries, impressive resorts, and rich history. Nonetheless, the primary reason this isn’t our top pick for the best state to retire in is that it isn’t the most tax-friendly.

West Virginia

Arkansas

Finally, the American state at the top of our list as the best place to retire in is Arkansas. The city of Bella Vista is the best place to call home if you’re a retiree. Health costs in this state have been voted as the third-best in the country for retired couples and it offers mountains, rivers, and hot springs.

Arkansas